GST/HST payment and filing deadlines Payment deadline Filing deadline Example; One month after the end of the reporting period: One month after the end of the reporting period: · Make a payment or pay your debt over time, if you cannot pay, confirm payments, or pay next year’s taxes by instalments. Payments for businesses. Make tax payments for In case of others, monthly E-Payment of Service Tax is to be made and due date for such payment is 6th of the month immediately following best replica watches the said month, but

E-payment Procedure

It is important to do the service tax payment within the due dates by the people and the companies who are eligible to pay the taxes. It is a mandatory task to pay the service taxes within the specified dates. Any person or company that has equal to or more than additional 9 lac rupees per year are compelled to register for the service tax and pay it.

At present, the service is a levy of 14 percent, service tax online payment due date. The people or the companies who provides services worth less than 10 lac rupees are free of the obligation to collect and pay the dues of the service tax. The following passages of this article will account the details of the service tax payment along with their due dates and other related information in India.

Mainly there are service tax online payment due date formats of the due dates for the payment of service taxes. This can be done either monthly or quarterly. All the information regarding this topic has been detailed in the list below. The payment is to be done quarterly for the individuals who are providing services with compulsory taxation, service tax online payment due date. If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are:.

If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the individuals are:. The payment is to be done quarterly for the proprietorship who are providing services with compulsory taxation. If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the proprietorships are:.

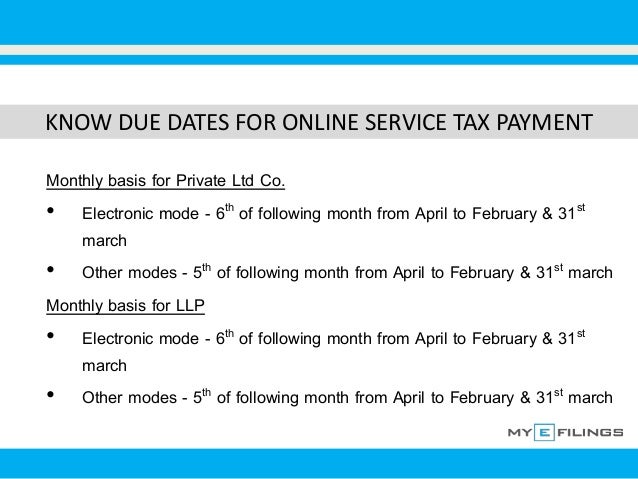

The payment is to be done quarterly for the partnership who are providing services with compulsory taxation. If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the service tax payment for the partnerships are:. The payment is to be done monthly for the private limited companies who are providing services with compulsory taxation.

If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the private limited companies are:. The payment is to be done monthly for the LLP limited liability Partnership who are providing services with compulsory taxation.

If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the service tax payment for the LLP limited liability Partnership are:. The payment is to be done monthly for the One-person Company Service OCP who are providing services with compulsory taxation. If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the One-person Company Service OCP are:.

All the companies or individuals who are eligible to pay the service tax or those who has done the service tax online payment due date of the service tax are bound to file the returns of the service tax.

Those who have done the registration of the service tax payment are mandated to file the returns of the service tax. It has to be done online. The due dates of the service tax service tax online payment due date to be done twice per year, service tax online payment due date. These are:. Company Vakil can be very helpful with the filing of the Service Service tax online payment due date return. To know more about the filing of the Service Tax returns, visit CompanyVakil.

Payment of the service tax is to be done through the GAR-7 challan, service tax online payment due date. In this case, the payment of the tax is to being done through a check, then the date of the payment is the date when the check is presented in the Bank and it is subjected to realization. It is better to make the payment online. An Assessee is mandated to make the payment online if the he or she fulfills the conditions given below:.

For the payments that are done late, some penalties are exercised. At present, the penalty for belated payment of the service tax is to pay the simple interest along with the actual payment. Note that if the Assesse if an individual service provider with taxable services that are provided in one financial year do not cross the limit of 60 lac rupees worth for those services, then the interest rate of the penalty is diminished by 3 percent. For more information about the service tax payment or filing of the returns of service tax, visit, CompanyVakil, service tax online payment due date.

What is Provident Fund? Provident Fund which is also known as the Pension Fund is a scheme providing certain Introduction: The GST Council declared the anti profiteering rules on eighteenth June Anti Profiteering rules are required as Is pension a subject to tax? The definition also includes in itself wages, annuity, pension, gratuity, service tax online payment due date, Introduction Goods and Services Tax GST is an indirect tax or a consumption tax levied in India on the supply of goods and services HUF means a Hindu Undivided Family.

You can save a lot of taxes by creating a family unit and pooling AS 19 coves the policies for accounting in regards to leases. What is a lease? According to the accounting All Rights Reserved. or Create an account. Contact Us. Toggle navigation. Home Learn Company Registration Private Limited Company One Person Company OPC Limited Liability Partnership LLP Intellectual Property Trademark Registration Trademark Objection Copyright Registration Patent Registration Mandatory Compliance GST Registration Import Export Code MSME Registration Privacy policy SSI Registration Our Services Start a Business Private Limited Company Limited Liability Partnership One Person Company Intellectual Property Trademark Registration Trademark Objection Trademark Renewal and Assignment Copyright Registration Patent Registration Mandatory Compliance GST Registration MSME Registration Import Export Code Legal Documentation Terms of Services Founders Agreement Employment Contract Contact Us Legal Library Glossary Agreements Bare Acts Rules Supreme Court Judgement Legal Forms Areas of Law Legal Tips.

Due Dates for the Service Tax Payment Home Due Dates for the Service Tax Service tax online payment due date. Due Dates for the Service Tax Payment Mainly there are two formats of the due dates for the payment of service taxes. Quarterly Payment — Due Dates of the Payment of Individual Service Tax The payment is to be done quarterly for the individuals who are providing services with compulsory taxation.

If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are: 6 th of July 6 th of October 6 th of January 31 st of March If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the individuals are: 5 th of July 5 th of October 5 th of January 31 st of March Quarterly Payment — Due Dates of the Payment of Proprietorship Service Tax The payment is to be done quarterly for the proprietorship who are providing services with compulsory taxation, service tax online payment due date.

If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are: 6 th of July 6 th of October 6 th of January 31 st of March If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the proprietorships are: 5 th of July 5 th of October 5 th of January 31 st of March Quarterly Payment — Due Dates of the Payment of Partnership Service Tax The payment is to be done quarterly for the partnership who service tax online payment due date providing services with compulsory taxation.

If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are: 6 th of July 6 th service tax online payment due date October 6 th of January 31 st of March If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the service tax payment service tax online payment due date the partnerships are: 5 th of July 5 th of October 5 th of January 31 st of March Monthly Payment — Due Dates of the Payment of Service Tax of Private Limited Company The payment is to be done monthly for the private limited companies who are providing services with compulsory taxation.

If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are: 6 th of each month except March 31 st of March If the format of the payment is to be paid in any other format other than electronic medium, service tax online payment due date the due dates of the payment of the service tax for the private limited companies are: 5 th of each month except March 31 st of March Monthly Payment — Due Dates of the Payment of Service Tax of LLP limited liability Partnership The payment is to be done monthly for the LLP limited liability Partnership who are providing services with compulsory taxation.

If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are: 6 th of each month except March 31 st of March If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the service tax payment for the LLP limited liability Partnership are: 5 th of each month except March 31 st of March Monthly Payment — Due Dates of the Payment of Service Tax of One-person Company Service The payment is to be done monthly for the One-person Company Service OCP who are providing services with compulsory taxation.

If the format of the payment is to be paid through an electronic medium such as online banking, then the due date of the payment of the service tax are: 6 th of each month except March 31 st of March If the format of the payment is to be paid in any other format other than electronic medium, then the due dates of the payment of the service tax for the One-person Company Service OCP are: 5 th of each month except March 31 st of March Return Due Date of the Service Tax Payment All the companies or individuals who are eligible to pay the service tax or those who has done the registration of the service tax are bound to file the returns of the service tax.

These are: 25 th April 25 th October Company Vakil can be very helpful with the filing of the Service Tax return. com How to make the Service Tax Payment Payment of the service tax is to be done through the GAR-7 challan. An Assessee is mandated to make the payment online if the he or she fulfills the conditions given below: Has made payment of service tax totaling one lac rupees along with the amount that is paid through the utilization of the credit of CENVAT The payment is done in the previous FY financial year Penalty for Belated Service Tax Payment For the payments that are done late, some penalties are exercised.

Share this. Related Articles, service tax online payment due date. Provident Fund AhanaOctober 11, July 9, What is Provident Fund? Information On The rules of Anti ProfiteeringSeptember 30, July 9, Introduction: The GST Council declared the anti profiteering rules on eighteenth June mayankJanuary 23, July 9, Is pension a subject to tax?

A Guide On GST and Anti-profiteeringservice tax online payment due date, September 30, July 9, service tax online payment due date, Introduction Goods and Services Tax GST is an indirect tax or a consumption tax levied in India on the supply of goods and services Hindu Undivided FamilySeptember 20, July 9, HUF means a Hindu Undivided Family. How is take home different from CTC? mayankJanuary 15, July 9, How is take home different from CTC? Ever asked why the salary you bring home is a ton AS LeasesOctober 10, July 9, AS 19 coves the policies for accounting in regards to leases.

Contact us. CONTACT US We're not around right now. But you can send us an email and we'll get back to you, asap. Send Sending. Log in with your credentials or Create an account. Forgot your details? Create Account.

E Payment of Service Tax

, time: 10:03Due Date for Payment of Service Tax - NVC & Associates NVC & Associates

· Make a payment or pay your debt over time, if you cannot pay, confirm payments, or pay next year’s taxes by instalments. Payments for businesses. Make tax payments for Due date. Your completed tax return and payment must be received on or before the last day of the month following the end of the reporting period. If the due date falls on a weekend or a · Due Date Deposited electronically through internet banking: In any other mode: Individual or Proprietary Firm or Partnership Firm: Quarterly: 6 th day of the month

No comments:

Post a Comment